A new pair of genes

The UNC School of Medicine opened its Gene Therapy Center in Chapel Hill in 1993. The center’s ultimate goal is to transition gene-therapy research from the laboratory into Phase I clinical trials to treat various diseases. Photo provided by UNC Health Care and UNC School of Medicine, Brian Strickland

Advances in gene therapy are saving lives in North Carolina’s Research Triangle.

Quick look: The Triangle area is home to more than a dozen gene-therapy organizations and leads the nation in per-capita funding from the National Institutes of Health.

By Jim Shamp

In partnership with the North Carolina Biotechnology Center

If you spin a globe and push a pin into the “capital” of gene therapy, your pin will end up in North Carolina’s Research Triangle.

Impressive, considering the fact that gene therapy is poised to change the lives of scientists, businesses and patients all around that globe.

The Research Triangle, located in the Piedmont region of the state, got its name from its 20-mile proximity to three world-renowned research universities: North Carolina State University, Duke University and the University of North Carolina at Chapel Hill. And it’s contributing mightily to North Carolina’s 35-year transformation into a life-science magnet.

A cute little Connecticut kid named Conner Curran personifies the amazing potential for gene therapy — and for the Triangle’s contribution to its life-saving potential.

Conner was only 4 years old when his parents, Christopher and Jessica, learned the reason why he wasn’t able to keep up with his twin brother, Kyle, or even his 2-year-old brother, William, in typical playground romping.

In 2015 Chris and Jessica took Conner for medical testing. That’s when they got some of the worst news that parents could imagine: Despite the genetic makeup shared by twins, Conner had inherited a faulty gene that Kyle didn’t have. That saddled Conner with a degenerative disorder shared by about one of every 3,500 boys at birth: Duchenne muscular dystrophy.

The Currans learned that boys with DMD usually lose the ability to walk by age 12 and die of cardiac or respiratory failure by their mid-20s. The abbreviated lives of kids with DMD are defined by painful, unstoppable muscle-wasting, ultimately leaving them unable to move, communicate, swallow or breathe.

Cambridge, Mass.-based bluebird bio develops pioneering gene therapies for severe genetic diseases and cancers. At bluebird’s 125,000-square-foot Durham manufacturing plant, which opened in early 2019, the company produces lentiviral vectors for the its gene and cell therapies.

When Conner was diagnosed, he was a bright and curious preschooler, able to do some of the things his siblings and peers could do with the help of numerous medications and frequent physical therapy. But his muscles were not developing like those of healthy children. Instead, they were turning into unruly fibrous tissue destined for failure. So Conner had to stand at the sidelines of the playground, watching as other kids played.

“When this diagnosis of DMD entered our family, it truly impacted our entire family,” says Jessica, a first-grade teacher in Ridgefield, Conn. “We all had hopes and dreams for Conner the day he was born.”

The Currans, like many families confronting deadly diseases such as DMD, organized and joined support groups. They researched treatment possibilities, including clinical trials for new approaches that might offer hope where none had ever existed.

So in March 2018, the family headed to North Carolina. Edward Smith, a Duke associate professor of pediatrics and neurology, invited Conner to participate in a new clinical trial of a DMD gene therapy.

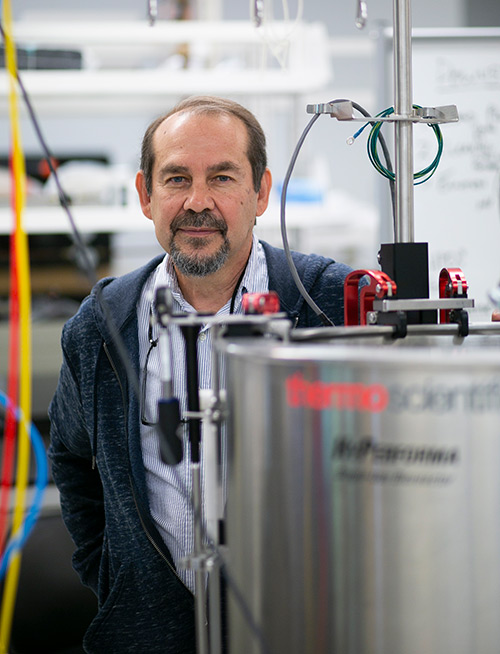

The therapy is a direct result of seminal discoveries made by gene-therapy scientist Jude Samulski while he was a postdoctoral researcher at the University of Florida. He later became the director of the Gene Therapy Center at UNC Chapel Hill, about 12 miles from the Duke hospital. Samulski is also co-founder of the prolific Research Triangle Park gene-therapy company Asklepios BioPharmaceutical, commonly known as AskBio.

Samulski came to the UNC School of Medicine from the University of Pittsburgh in 1993. His recruitment was bolstered by about $250,000 in grant funding and other support to UNC Chapel Hill from the North Carolina Biotechnology Center. Eight grants and loans from the taxpayer-funded Biotech Center totaling about $1.5 million have supported Samulski’s academic research and commercial technologies at the School of Medicine’s Gene Therapy Center and at AskBio.

Those foundational outlays have brought huge returns to North Carolina, totaling nearly $600 million in follow-on investments in Samulski’s research and resulting companies. It amounts to more than $400 for every dollar of support from the Biotech Center.

The DMD therapy was under development by an AskBio spinout, Bamboo Therapeutics of Chapel Hill, when Bamboo was purchased by global pharmaceutical giant Pfizer in 2016.

During Conner’s visit to Duke, he became the first person to receive the two-hour intravenous infusion of Pfizer’s experimental gene therapy. By the end of summer 2019, Pfizer had given the one-time infusion of the “genetic liquid,” the fluid volume equivalent of about half a can of soda, to six boys with DMD. Results will continue to unfold for years.

“Conner experienced some nausea and no appetite the third day after the infusion, for a brief 24 hours,” Jessica says. “We happened to be at Jude [Samulski]’s house that day, thank God, because he eased our worry. He invited us to his home for a party he was having for his family. As you can see, we quickly became close with Jude.”

Conner’s nausea is a common early side effect from the boys’ bodies’ confrontation with their adeno-associated virus gene therapy treatments. But those discomforts are treated by professionals overseeing the clinical trial volunteers, and the boys are able to go home after about a week of observation and care.

This is groundbreaking medical research. And if the DMD gene therapy proves to be generally safe and tolerable, the next big question is effectiveness: Ultimately, can it bring the sustained genetic changes that would classify it as a lasting cure?

In August 2019, Pfizer Inc. announced a $500 million effort to add 130,000 square feet and 300 employees to its 230-acre Sanford campus that manufactures clinical trial and commercial drug materials for vaccines. The company invested $100 million in 2017 to expand the campus and add 40 people to its more than 600-person workforce.

“Conner had a substantial overall improvement in his function after the gene therapy,” Jessica says. “He continued to improve greatly for months. He was doing things he could never do before — climbing stairs, jumping on two feet. But I think the increased stamina was the biggest thing for us. He used to come home from school and crash on the couch. Before the therapy, his teacher said that Conner would fall asleep on the carpet after lunch; he just couldn’t keep up. Now he can go for long walks and does not ask to be picked up.”

“Jessica sent me some pictures of Conner running and swimming,” Samulski says. “It’s amazing. Every time I see it, I can’t believe it’s true. It’s a ‘streak-across-the-sky’ type of feeling.”

AskBio, established in 2001, is the 21st-century life-science equivalent of Thomas Edison’s lab. But this version has racked up more than 500 patents and processes on a uniquely end-to-end technology platform with globally lifesaving potential. This unicorn is growing steadily — not in Boston or Silicon Valley — but in central North Carolina’s woodsy, iconic Research Triangle Park.

The small company has an uncanny knack for building a “supply chain” of scientific innovation through its own labs and collaboration with others. It’s effectively converting basic research findings into valuable gene therapies poised to correct a wide range of human maladies.

Samulski, now a vigorous 65-year-old grandfather, is revered in scientific circles as a pioneer in the use of the live, but harmless, recombinant adeno-associated virus as the premier delivery mechanism, or vector, for gene therapy. It uses the natural tendency of viruses to attack cells. He has tweaked the process to make sure AskBio technology gets healing power from the warfighting tendencies of invasive viruses and the body’s natural defensive maneuvers.

The U.S. Food and Drug Administration approved the first Samulski-based gene therapy for human use in December 2017. Brand-named Luxturna by Spark Therapeutics, a Philadelphia pharmaceutical startup, it relies on the technology to replace a defective gene in patients with a rare inherited vision-loss disease. In the U.S., the disorder is currently found in only 1,000 to 2,000 children.

The second FDA approval of an AskBio-derived gene-replacement therapy came in May 2019 with AveXis’ Zolgensma. It treats spinal muscular atrophy, an inherited and deadly neuromuscular disease that, like DMD, limited its victims’ treatment options. Zolgensma was also created from Samulski’s technology.

AskBio received an undisclosed upfront payment, milestone payments and royalties based on AveXis’ successful development and commercialization of Zolgensma. After AveXis bought rights to Zolgensma, Novartis bought the company for $8.7 billion to get control of the AskBio-invented spinal muscular atrophy therapy. Now AveXis, headquartered in Bannockburn, Ill., is investing $115 million and hiring 400 people at its new Durham gene-therapy manufacturing facility.

These new approaches to wellness are expensive. Zolgensma’s one-time dose is priced at $2.1 million, the most expensive treatment in history. LentiGlobin, from bluebird bio, which has a manufacturing facility in Durham, was approved in June 2019 for the European market at $1.8 million a dose. Sparks priced Luxturna at $425,000 for each one-time injection, or $850,000 for both eyes.

These kinds of numbers have led to new commercial and societal challenges and discussions about the companies’ need to recoup their development costs and to balance the costs and benefits of one-time, potentially curative, and often lifesaving treatments. The companies are establishing installment plans and spreading charges over five years. If the therapy stops working, the payments also stop coming to the company providing the therapy.

Building an end-to-end platform

To say AskBio is on a roll would be an understatement. It’s not only creating new and improved therapies, but it has also developed a proprietary cell line manufacturing process called Pro10 designed to streamline output and bring down the cost per dose.

The company is a beehive of activity, with scientists and other employees leaning into research, development and manufacturing, and company leaders fielding collaboration calls from around the world. After a recent $225 million venture capital investment, the largest-ever single round by a life-science company in the state, AskBio announced a collaboration and an acquisition in the span of just two weeks in August.

The company will partner with Boston-based Selecta Biosciences Inc. to develop an important way for gene-therapy recipients to receive subsequent doses, if needed. Researchers in the relatively nascent field have been concerned that some gene therapies put recipients’ immune systems on alert, so a second dose might become dangerous. That could be a problem if a very young child gets an especially small infusion that turns out later to have been inadequate for an adult body.

AskBio acquired Scottish company Synpromics Ltd. to incorporate the Edinburgh firm’s gene-control technology and expertise in bioinformatics and data-driven design to allow more precise cell targeting and gene expression.

AskBio has spun out numerous gene-therapy companies besides Bamboo, including Chapel Hill’s Chatham Therapeutics, purchased by Baxter International in 2014 for $70 million, and RTP’s NanoCor Therapeutics, which is developing treatments for cardiovascular disease. AskBio also has about a dozen additional partnerships with companies around the world.

Jude Samulski, AskBio

Samulski took a sabbatical from UNC and joined Pfizer in Sanford for slightly more than a year, as vice president of gene therapy, after its purchase of Bamboo. After overseeing the roll-out of the DMD clinical trials, he transitioned back to UNC and then to AskBio as the company’s scientific founder and chief scientific officer.

Pfizer’s 230-acre Sanford campus manufactures clinical trial and commercial drug materials for vaccines. But Pfizer, already the world’s largest pharmaceutical company, recognized North Carolina’s workforce excellence and gene therapy leadership. So the company invested $100 million in 2017 to expand its Sanford site and add 40 people to the site that already employed more than 600 workers. In August 2019, the company announced an additional $500 million effort to add 130,000 square feet and 300 employees to the highly specialized manufacturing project.

Pfizer’s acquisition of Bamboo also led Samulski to link the global pharmaceutical company with NC Biotech. That resulted in a transformative $4 million postdoctoral fellowship program in gene therapy.

“If our universities can continue to pump out the next generation of leaders, with the right formula, it will continue what the Biotech Center had the wisdom to start in 1993 by putting the funding in,” says Samulski. “We pioneered it, we lead it.

“We are creatures of our genetics, and this is the final arena. It’s thrilling to be part of it. Like a moon shot, every time it can put a flag in the sand. And it’s pretty impressive that North Carolina is set to become the Silicon Valley of gene therapy.”

AskBio and a variety of other companies are developing AAV to treat a wide range of genetic afflictions. These include big puzzles such as hemophilia, congenital heart failure, cystic fibrosis, Parkinson’s, Alzheimer’s, epilepsy, Lou Gehrig’s disease and macular degeneration. The technology developed by Samulski is the foundation for more than two-thirds of the gene-therapy industry worldwide.

It’s significant that more than a dozen of those companies have established some or all of their business operations in the Triangle area. That may not be surprising, perhaps, since the Triangle is also leading the nation in per-capita funding from the National Institutes of Health.

Still, it’s a leading indicator of what’s to come for the sector and for the Triangle. The global gene-therapy market is expected to be five times greater by 2026. There are already reportedly more than 1,800 clinical trials underway for gene therapies.

AN EXPANDING ROSTER

bluebird bio is one of many gene-therapy companies established in the Triangle area.

Besides AskBio, AveXis, Bamboo and Pfizer, other gene-therapy companies established in the Triangle include:

Adrenas Therapeutics Inc.

Palo Alto, Calif., with Raleigh site

Axovant Sciences

Basel, Switzerland, with Durham site

bluebird bio

Cambridge, Mass., with facility in Durham

Couragen Biopharmaceutics

Chapel Hill

Enzerna Biosciences Inc.

Raleigh

Genencine Therapeutics

Durham

OncoTrap Inc.

Research Triangle Park

Precision BioSciences Inc.

Research Triangle Park

StrideBio Inc.

Durham

Triangle gene-therapy suppliers/support companies include:

Advanced Cell and Gene Therapy

Chapel Hill

Columbus Children’s Foundation

Research Triangle Park

Cmed Clinical Services

Morrisville

ZenBio

Research Triangle Park

General BioSystems

Durham

GENEWIZ

Research Triangle Park

Neochromosome

Chapel Hill